To borrow a phrase from an iconic television show, apartment rents as well as interest in multifamily construction are “moving on up” across the nation, industry experts and observers say.

The multifamily sector has been one of the healthiest within the real estate industry for some time now, and the past year has been no exception.

Investors have been grabbing up properties quickly, still enjoying the resurgence created by the mortgage meltdown and other issues plaguing residential properties, pushing more people toward renting apartments and condominiums than ever before.

Rents for new leases in the 100 largest U.S. apartment markets grew 3.3 percent in the first quarter of 2014, according to MPF Research, a division of RealPage, Inc.

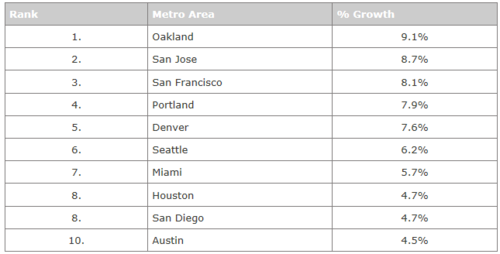

Major metropolitan areas on the West Coast are leading the increases. The top 10 leaders of rental growth for the first quarter of 2014 were:

Metropolitan areas in the Northeast and mid-Atlantic areas are missing from the list, in large part because of the rugged winter that brought a more conservative approach to rent increases, MPF said.

One company feeling bullish on secondary markets is The Marquette Companies, which in 2013 invested in several non-core urban projects, including a 400-unit rental community in Granger, Ind.

“As the competition for properties in major metropolitan areas has increased, it has pushed pricing to a point that has made it more difficult to buy in those areas,” said Darren Sloniger, managing director of acquisitions for The Marquette Companies. “Purchasing well-located properties in secondary markets with high barriers to entry provide a good alternative for us right now.”

More importantly, apartment properties have benefited from generational trends. For example, younger renters – mostly people from Generation X and Y – are still looking to settle down without a long-term commitment to a house.

Additionally, Baby Boomers are continuing to seek spots to downsize from their family-friendly houses.

Job growth in larger cities, along with renters’ natural attraction to “walkable” urban areas, is also seeding apartment growth. Consumer confidence is expected to continue to move upward as well, giving the nation another reason to celebrate its good fortune and movement toward a healthier economy, experts agree.

Looking forward, the Urban Land Institute predicts the U.S. real-estate recovery is going to continue into 2014. Investors who may feel that more popular areas are becoming saturated will move into other, secondary markets, giving them higher returns and boosting the industry across the board.

“We have been seeing an explosion in the New York City market in recent months. With inventory at a record low, many of the apartments are experiencing bidding wars. We are also experiencing a large shift to all-cash buyers, driven by foreign investors looking for a place to park their money,” said Phil Lang, who started the software-powered real-estate brokerage Suitey two years ago.

Apartment research firms generally expect rents across the nation to increase in 2014 as well. Some cities will see smaller bumps, according to Axiometrics and Reis. But overall numbers are up over 3 percent.

Reis said it expects vacancy rates to rise slightly as more apartment units come onto the market. However, the firm generally agrees that vacancy rates will stay low – mostly within the single digits across the industry – for the year ahead and beyond because of the steady demand for these units across the board. The national vacancy rate at the end of the first quarter of 2014 stood at approximately 6 percent.

The average multifamily vacancy rate should edge up 0.1 percent, but that sector continues to see the tightest availability and biggest rent increases, according to the National Association of Realtors.

Apartment buildings that are within the mid- to high-income price range are among the strongest sectors going into 2014, according to a survey by the Urban Land Institute. Growing strength within residential real estate should not threaten the apartment outlook, the report noted. There may be some glut in the luxury market, but that can be easily remedied by a slowdown in construction, industry experts interviewed for the report said.

Generally, 2014 calls for continued recovery in the multifamily market that should result in a boost of new construction in excess of 400,000 units a year in 2014 and continuing through 2015, according to Rentlytics, which provides real-time analytics for apartment owners and managers.

Going forward, analysts believe that apartment dwellers will set many trends in terms of where they want to live and the amenities they desire. For example, urban areas are likely to enjoy a rise in interest, largely because Millennials want to live in what they describe as “walkable” areas that connect them easily and quickly to retailers, restaurants, coffee shops and dog parks.

This is also true of Baby Boomers, some of whom are enjoying younger retirements and secondary careers. They are looking to rent near downtowns or active senior centers that put them near entertainment venues and quality healthcare facilities.