Many tax-exempt organizations publish magazines or other periodicals that contain editorial material related to the organization’s exempt purpose. Often, these periodicals also contain commercial advertising.

When the advertising activity constitutes a trade or business regularly carried on by the organization, the sale of advertising represents an unrelated business activity. The organization will pay Federal (and likely state) income tax on this income if there is a net profit from the activity.

To determine the amount of unrelated business taxable income (UBTI) attributable to the sale of advertising, it is necessary to determine the following:

- Gross advertising income – All amounts derived from advertising activities.

- Direct advertising costs – All expenses which are directly connected to the sale, publication and distribution of advertising. These expenses are typically the cost of the labor used to sell the advertising (commissioned sales people or an allocated portion of an employee who is selling ads in addition to performing other duties) and an allocable portion of the costs of publication, usually consisting of printing, postage, etc. These “shared” costs must be allocated on a reasonable basis, which often means the relative percentage of pages of advertising compared to the pages of content.

- Circulation income – Income attributable to the production, distribution or circulation of a periodical, other than gross advertising income, including all amounts realized from or attributable to the sale or distribution of the readership content of the periodical. Revenues may include the sale of subscriptions and reprints or back issues of the periodical. Further, if members get the publication as a right of membership, then part of the organization’s dues revenue is treated as circulation income. While there are three tests for determining the allocable dues (see listing below), almost all organizations fall into the third test (based upon an inability to meet either of the first two tests). The third test requires an allocation of dues based upon the relative total cost of the publication to the total cost of the publication plus the expenses of all exempt activities of the organization. Thus, if the publication costs are 10% of the organization’s total exempt activity costs, then 10% of the dues must be treated as circulation income.

- Readership costs – All expenses which are directly connected with the production and distribution of the readership content (non-advertising) of the periodical. All the costs of the periodical that are not “direct advertising costs” as described above are considered readership costs.

Calculation

If direct advertising costs exceed gross advertising income, the excess is allowable as a deduction in determining the UBTI of an organization that has income from other unrelated trade or business activities (or can be carried forward to be used as a deduction in future years where there is taxable income).

However, from a practical perspective, it is rare for the direct costs of advertising to exceed the advertising revenue.

If gross advertising income exceeds the direct advertising costs, the items of deduction attributable to the production and distribution of the readership content of the periodical – to the extent such deductions exceed circulation income – may be deducted from the excess advertising income in calculating UBTI from the advertising activity.

However, no overall loss may result from this deduction, meaning that an organization cannot use the excess readership costs to “shelter” any UBTI from other activities. In essence, the advertising income is subject to tax only if the periodical produces an overall profit for the year.

If the circulation income of the periodical equals or exceeds the readership costs, the organization is not required to use circulation income and readership costs in calculating UBTI. Instead, UBTI is only the excess of the gross advertising income over direct advertising costs.

If an exempt organization publishes two or more periodicals, it may be able to consolidate the results for all periodicals.

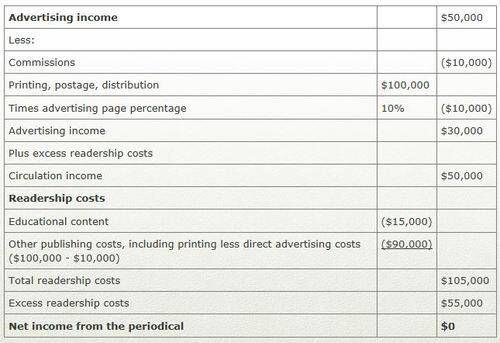

Example: An exempt organization produces a monthly periodical that contains advertising in each issue. The periodical generates $50,000 of advertising revenue. In selling the advertising, the organization incurs $10,000 of commissions related to the sale of the ads.

The cost of printing, postage and distribution of the periodical is $100,000. Ten percent of the total periodical pages contained advertising. The organization also incurs an additional $15,000 of costs associated with producing the educational content of the periodical.

Circulation income (as calculated in the example below) is $50,000.

The UBI from this activity is calculated as follows:

Member Dues Allocation

When the payment of a membership fee entitles the member to receive a periodical, circulation income includes an allocable portion of the membership fee, using one of three allocation methods:

- If 20 percent or more of the total circulation of the periodical is sold to nonmembers, members are deemed to have paid the same subscription price as part of their membership fee. Because some organizations sell/distribute the periodical to a wide audience outside of its membership, this rule may apply.

- If 20 percent or more of the members pay lower dues because they elect not to receive the periodical, the difference in the dues is used as the subscription price. As a practical matter, it would be very rare to find an organization that had a second class of membership determined solely by the removal of the periodical as a right of membership.

- When neither of these tests applies, membership fees are treated as circulation income based on the ratio of total periodical costs to total periodical costs, plus the cost of the organization’s other exempt activities.

Example:

Assuming the same facts as above, A has costs incurred for other exempt expenditures of $500,000 and total member dues of $250,000. Total expenses for the journal are $125,000 ($10,000 commissions, plus $100,000 distribution plus $15,000 for the educational content). Dues allocated to circulation income (under #3 above) are calculated as follows:

$125,000/$625,000 ($500,000 plus $125,000) or 20 percent times $250,000 (member dues) = $50,000.